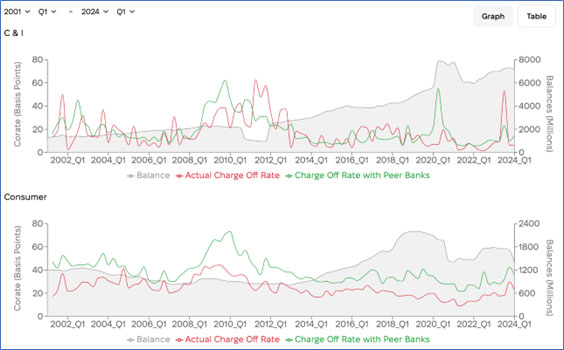

Evaluate and control risk of borrower defaults. Our robust models and validation processes enable precise credit assessments, supporting informed decision-making and maintaining financial stability.

We develop Current Expected Credit Loss (CECL) model for primary or benchmark uses leveraging bank’s internal data or FDIC call report data.

Develop credit stress testing using CECL model using economic scenario from Moody’s or Fed CCAR.

Develop loan rating models (PD/LGD/EAD) using bank’s internal loan data.

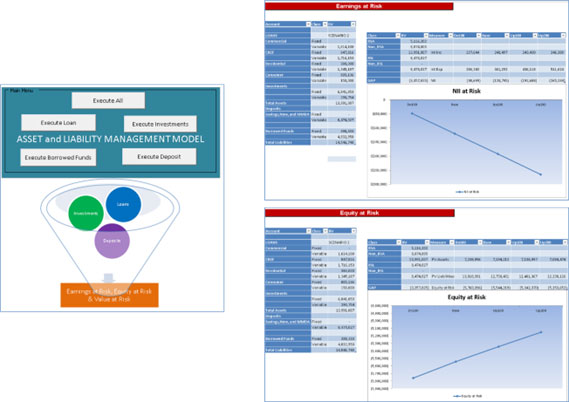

Provide comprehensive solutions to measure, monitor, and mitigate risks arising from fluctuations in market prices and interest rates.

Our expertise in model development and validation ensures accurate risk assessments, helping banks navigate volatile market conditions with confidence.

We assist banks in implementing Asset Liability Management (ALM) models to balance assets and liabilities, optimizing profitability and managing risk exposure for long-term financial stability.

We help banks with Liquidity Stress Test models to evaluate their ability to withstand extreme market conditions, ensuring sufficient liquidity to meet obligations during financial stress.

Our services support banks in conducting Capital Stress Test models, assessing capital adequacy under various adverse scenarios to maintain robust capital reserves and regulatory compliance.

We provide expertise in Value at Risk (VaR) models, helping banks measure potential losses in their portfolios over specified time frames, offering quantitative risk assessments to inform risk management strategies.

We assist banks with Expected Shortfall models to calculate average losses in the worst-case scenarios beyond the VaR threshold, enhancing understanding of tail risk and improving risk mitigation efforts.

Help banks adhere to regulatory requirements such as Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA). We validate robust models to detect and prevent financial crimes, ensuring you remain compliant and safeguarded against legal and reputational risks.

Provide actionable data strategy to prioritize business needs across data governance initiatives such as metadata management, data quality, secure data access for analytics and GenAI model development, and data security.

| Technical Metadata | Operational Metadata | Business Metadata |

|---|---|---|

| Sample Attribute Lists | Sample Attribute Lists | Sample Attribute Lists |

| Database Name | Job Name | Business Owner |

| Schema Name | Job Step Name | Data Owner |

| Table Name | Job Description | Data Stewards |

| Column Name | Last Execution Date | BU Risk Owner |

| Data Type | Application Name | Business Name (table, columns) |

| Report Name | Service Account Name | Business Description |

| Metrics Name | Data Classification Type (Restricted, Confidential, Private, Public) | |

| Model Name | Tags | |

| File Location |

Purpose: Maintain data consistency and integrity for tables and columns

Purpose: Increase usage to governed data

We design data quality rules and solution that are developed once and scaled across databases and data platform for customers. We develop data quality dashboards, controls and KRIs to improve trust in data.

| DQ Name |

| Description |

| Business Process Name |

| Data Steward |

| Code Snippet |

| Associations • Tables • Columns |

| Dimensions • Completeness • Uniqueness • Timeliness • Validity • Accuracy • Consistency |

| KRIs |

| Data Life Cycle | Testing Type | Monitor |

|---|---|---|

| Data Capture/Ingestion |

|

|

| ETL |

|

|

| Retain/Repository |

|

|

| DQ Overall Score |

| DQ Metrics by KDE |

| Coverage Score |

| Remediation Score |

| DQ Issue Management |

Our Advisory Services are tailored to collaborate closely with line of business owners, providing expert guidance and strategic insights to optimize risk management practices. Our advisory team brings deep industry knowledge and a proactive approach to empower your business with the tools and confidence needed to navigate the complex risk landscape. We identify and prepare risk inventory and risk appetite framework for the business. Our advisory services are isolated from model validation.

We offer comprehensive end-to-end model validation services in accordance with the SR 11-7 guideline. The SR 11-7 guideline, issued by the Federal Reserve, outlines rigorous standards for model risk management in financial institutions. It emphasizes the importance of robust model development, implementation, and validation processes to ensure models are accurate, reliable, and fit for their intended purpose. Adhering to SR 11-7 helps institutions mitigate model risk, enhance governance, and maintain regulatory compliance, thereby supporting sound decision-making and financial stability.

We partner with the industry standard tools and platforms;